The real impact of COVID on furniture supply

At KE-ZU we are committed to informing our customers about factors that impact the supply of our products.

Currently, there are extensive delays that are impacting our ability to perform to meet your needs, and this is the result of a phenomenon that is due to global forces.

Understanding the fundamentals underlining this situation serves to ensure that you are fully informed. We want to share this with you to assist you in your own understanding, as well as to provide you with a resource encompassing a full and extensive explanation to your clients.

This blog will bode you well to be aware of those bearing false promises.

The Impact of COVID

We all know about the human impact of COVID – but there is so much more to this story in the responses that followed, impacting supply to businesses globally.

Currently, there are delays in delivery and price increases impacting both the supply of furniture in Australia, sourced from overseas and locally.

WHY is this happening now?

Finalising orders for Christmas deliveries now!

Supply

1) Manufacturing companies were uncertain how to respond to the pandemic in 2020, and they reduced their stocks to preserve cash and manufacturing was often shut down due to the different impacts to their workforce from Covid globally.

2) Foam supply, there are only 3 chemical manufacturers who produce the starting material toluene diisocyanate or TDI for short. One of these plants failed for a long time and is not back to maximum production. There is not enough supply of this chemical for market demand and consequently, foam prices have increased by 60% as there is also strong demand in the mattress and auto industries.

3) Wood mills around the world are working to capacity. The industry has been plagued with labour force issues, beetle infestations due to climate change, and chemical shortages and increase costs in formaldehyde. Russia has banned log sales reducing supply to Europe. The price for wood has increased 400% in the USA – and due to that increase, a lot of wood from OS is going to the US market to take advantage of the higher prices.

4) Wood (Australia) – 60,000 hectares of softwood plantations were lost during the 2019-2020 bushfires. This is a raw material that takes 20-30 years to grow.

5) Plywood / Chipboard are scarce due to the increase in demand from furniture and kitchen manufacturers for booming lockdown renovations. There is not only the increasing cost in timber but there is also an increased cost in formaldehyde melamine, and methanol. Cardboard manufacturers need huge volumes of wood to produce cardboard boxes for Australia’s switch to online shopping.

5) Plywood / Chipboard are scarce due to the increase in demand from furniture and kitchen manufacturers for booming lockdown renovations. There is not only the increasing cost in timber but there is also an increased cost in formaldehyde melamine, and methanol. Cardboard manufacturers need huge volumes of wood to produce cardboard boxes for Australia’s switch to online shopping.

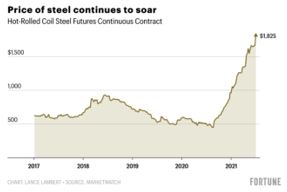

6) Steel prices have increased 200% in the US. At the beginning of 2020 many steel mills were closed – in the fear that the world was heading toward a recession or even a depression. A duopoly was created in the US – means that they are not increasing their production to protect higher steel prices. Iron Ore prices have increased by 120% since 2020 and will continue to rise. In Australia the price is has increased only 13%

Demand

1) Most governments responded to the pandemic by creating stimulus packages to stimulate economic activity which resulted in increased building activity.

2) This in turn created demand by people renovating their homes as people were not traveling as much – the excess cash has been applied to DIY and renovations.

3) The home renovation boom was also fuelled by global low-interest rates and saw the increase in house prices – also allowing people to borrow more. New housing demand in Australia has increased by 20%, which was also aided by the 400,000 ex-patriots returning home.

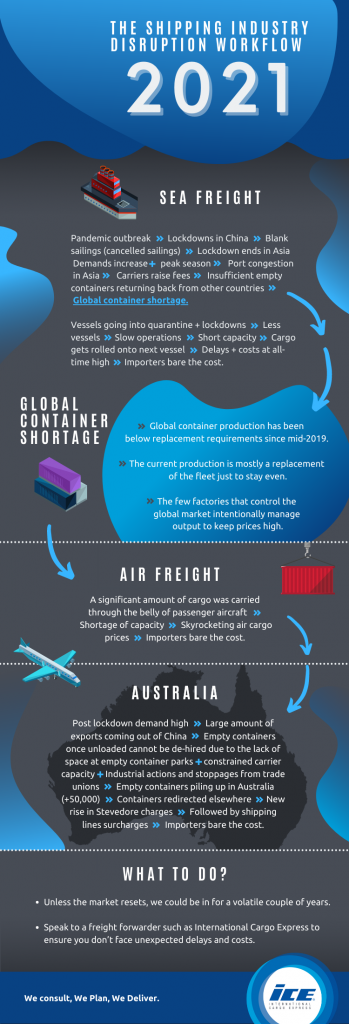

Freight

1) The cost of shipping a container has gone up massively, as there are fewer containers available, fewer ships, and more demand than supply.

1) The cost of shipping a container has gone up massively, as there are fewer containers available, fewer ships, and more demand than supply.

2) Pandemic-induced disruption has affected the speed and efficiency of seaborne traffic. The cost of shipping goods from China to Europe and from Europe to Australia has more than quadrupled in the past eight weeks.

3) Multiple factors are to blame. Empty containers were left stranded in Europe and the US after shipping lines canceled sailings in the pandemic’s early months. COVID-19 has also curbed ports’ capacity, pushing up container turnaround times by two-thirds to 100 days. Changing spending patterns from locked-down consumers have led to a surge in demand for goods. That would have been unmanageable even under normal circumstances, say experts.

4) The Suez Canal accident has also impacted further delays. “Despite the vessel now being cleared, the congestion at the Suez Canal has caused a backlog in global berthing schedules around the world,”

The diagram on the right summarises the impact very succinctly.

Our supplier’s response to the crisis

Each factory is ultimately doing the very best they can to meet increased demand. It is those companies that completely control the supply chain that are able to minimise the impact of price increases and supply interruption.

The procurement of raw materials is very complicated in Italy and there is reduced road freight exacerbating the situation. EMU continues to produce their products in-house and have always held a full year of stock on hand. They are doing their utmost to satisfy the large increase in the number of orders, (greater than in 2020) and it is not always possible to meet all orders and keep existing prices as they have done in years past.

The impact has been that they are having to make the following price increases

- steel tables +9%

- all other tables +5%

- Shade umbrellas +10%

In Spain, it is not much better however ANDREU WORLD (AW), have managed to keep price increases to 3%. While their prices usually remain stable, this larger than usual increase is the direct result of the increased cost of raw materials and packaging.

The good news is that most of the raw materials used in the AW plants are produced either in Spain or Europe, and they have been able to plan for this expected surge in demand. They have not experienced a shutdown of the factory or had to halt production, allowing for extended manufacturing times to be kept to a minimum.

AW have their own plantation of Euro Beech in the north of Spain, which has helped immensely in controlling their costs and supply. They do not depend entirely on wood as the only raw material, however, having access to wood certainly stabilises the impact on the shortage of other raw materials as being experienced by other manufacturers in the furniture industry.

Our current lead times by brand - as at August, 2021

14six8 LOCAL STOCK 6-8 weeks from receipt of deposit - 16 weeks if stock required

Andreu World 13-16 weeks from receipt of deposit

Artifort 16-18 weeks from receipt of deposit

AICHI 16-18 weeks from receipt of deposit, plus a possible 2 weeks due to limited availability of global shipments

Arcadia 4-6 weeks from receipt of deposit

Bernhardt Design 16-18 weeks from receipt of deposit, plus a possible 2 weeks due to limited availability of global shipments

Eden 13-16 weeks from receipt of deposit

Emu 16-20 weeks from receipt of deposit

Enea 13-16 weeks from receipt of deposit

Expormim 12-15 weeks from receipt of deposit

Global 16 weeks from receipt of deposit

Kenneth Cobonpue 17-21 weeks from receipt of deposit, plus a possible 2 weeks due to limited availability of global shipments

LZF 13-16 weeks from receipt of deposit

Mobles114 20 weeks from receipt of deposit

New Design Group 18-20 weeks from receipt of deposit

Nightingale LOCAL STOCK 2 weeks | STOCK REQUIRED 16 weeks

Parachilna 18-20 weeks from receipt of deposit

Sancal 13-16 weeks from receipt of deposit,

Simon 7-9 weeks from receipt of deposit

Source 4-6 weeks from receipt of deposit

Swiss Design all local products 8-10 weeks from receipt of deposit

Tuuci PARASOLS 40-46 weeks | CABANA without fabrics 22-26 weeks

Vondom 12-15 weeks from receipt of deposit

** Please note; where upholstery of a product is involved, lead times are based on receipt of fabric/leather to overseas suppliers.